Embarking on the journey of investments can be both thrilling and overwhelming, especially in a world brimming with a multitude of financial instruments. One such powerful tool in the realm of investments is the Exchange-Traded Fund (ETF). Imagine a tool that combines the potential for solid returns with the diversification benefits typically found in mutual funds. In this blog post, we unveil the strategies and insights essential to master the art of investing in ETFs.

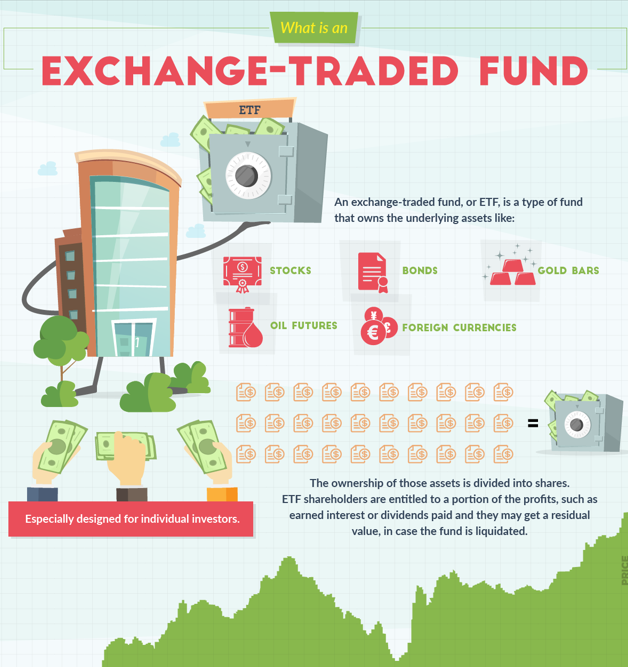

Exchange-Traded Funds, or ETFs, represent a basket of securities—stocks, bonds, commodities—traded on stock exchanges, offering diversification and often lower expenses. They’re designed to track the performance of specific market indices or sectors. Understanding how to navigate this dynamic financial instrument can significantly bolster your investment portfolio.

These funds are unique in that they can be bought or sold on an exchange at market prices throughout the trading day. This provides flexibility, liquidity, and an opportunity for investors to react to market changes promptly.

ETFs also often come with lower expense ratios compared to traditional mutual funds. This is because many ETFs are passively managed, aiming to replicate the performance of a particular index rather than outperform it. This cost-efficiency is appealing to investors aiming to optimize their returns.

Just like any investment, approaching ETFs with a clear strategy can be the key to success. In this guide, we’ll delve into various strategies and considerations vital for navigating the ETF landscape intelligently. Whether you’re a novice investor or a seasoned pro, mastering these strategies can set you on a path to harness the full potential of ETFs.

Let’s uncover the strategies that can lead you to success in the world of ETF investments!

II. Understanding Exchange-Traded Funds (ETFs)

A. Defining Exchange-Traded Funds

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, similar to individual stocks. They consist of a diversified portfolio of assets such as stocks, bonds, commodities, or a mixture of these, aiming to track the performance of a particular index or sector. ETFs offer investors exposure to a broader market or a specific industry without requiring them to purchase each individual asset.

These funds are known for their flexibility and liquidity, as they can be traded throughout the trading day at market prices. ETFs have gained immense popularity due to their ease of access and lower fees compared to traditional mutual funds.

B. How ETFs Work

ETFs operate based on the creation and redemption mechanism. Authorized Participants (APs) create new shares of an ETF by assembling a portfolio of the underlying assets and exchanging them with the ETF issuer. The issuer then provides these new shares to the APs, who can trade them on the market. Conversely, when an investor wants to sell ETF shares, APs buy them and redeem them for the underlying assets or cash.

This creation and redemption process ensures that the market price of an ETF stays in line with its net asset value (NAV), maintaining a fair market value for investors.

C. Types of Exchange-Traded Funds

- Equity ETFs: These track a specific stock index or sector, providing exposure to a range of companies in various industries.

- Fixed Income ETFs: Comprising bonds and other fixed-income securities, they offer investors exposure to the bond market and its various segments.

- Commodity ETFs: These track the price of commodities like gold, oil, or agricultural products, allowing investors to invest in these markets indirectly.

Understanding the types of ETFs available helps investors choose the most suitable options based on their financial goals and risk tolerance.

III. Advantages of Investing in ETFs

A. Portfolio Diversification

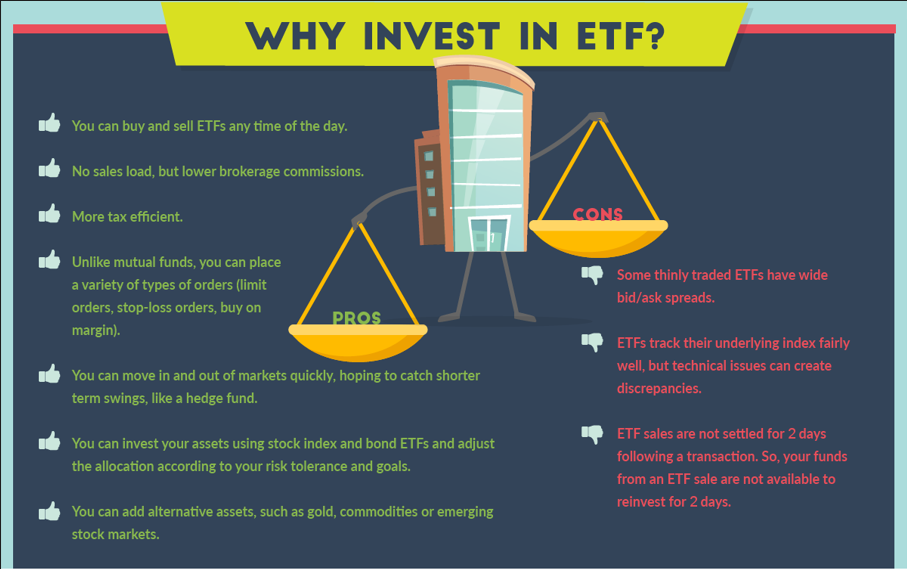

One of the primary advantages of investing in Exchange-Traded Funds (ETFs) is portfolio diversification. ETFs typically hold a diversified portfolio of securities, which can include stocks, bonds, or other asset classes. This diversification helps spread risk, reducing the impact of adverse movements in any single asset.

Investors can gain exposure to a broad market, a specific industry, or a particular asset class through a single ETF investment. This can be particularly beneficial for those seeking a well-rounded portfolio.

B. Lower Expenses and Fees

ETFs often come with lower expense ratios compared to actively managed mutual funds. Since many ETFs are passively managed and aim to replicate the performance of a specific index, they have fewer management and operational costs. Lower expenses mean higher net returns for investors.

Additionally, due to their structure and trading mechanism, ETFs may have lower transaction costs compared to buying individual securities, especially for investors engaging in frequent trading.

C. Flexibility and Transparency

ETFs provide investors with a high level of flexibility. They can be bought and sold throughout the trading day at market prices, offering intraday liquidity. This flexibility allows investors to react quickly to market changes or adjust their investment strategies.

Moreover, ETFs disclose their holdings daily, providing transparency about the assets in the fund. This transparency enables investors to make informed decisions about their investments.

Understanding and leveraging these advantages can significantly enhance an investor’s portfolio and overall investment strategy.

IV. Risks and Considerations in ETF Investing

A. Market Risks

While ETFs offer diversification, they are still subject to market risks. Fluctuations in the underlying securities, changes in interest rates, economic conditions, or geopolitical events can impact the value of the ETF. It’s important for investors to assess and understand these market risks before investing.

B. Tracking Error and Tracking Difference

Tracking error refers to the discrepancy between the performance of the ETF and its underlying index. It can result from various factors such as fees, expenses, and tracking method. Investors should be aware of the tracking error to evaluate the fund’s performance accurately.

Tracking difference is the difference between an ETF’s returns and the returns of its benchmark index. High tracking difference could indicate that the ETF is not effectively mirroring the index, affecting the expected returns.

C. Understanding the Underlying Index

The performance of an ETF is directly tied to the performance of its underlying index. Investors need to understand the components of the index, the sectors it represents, and how changes in the index affect the ETF. Additionally, changes in the index methodology can impact the ETF’s performance and risk profile.

Being aware of these risks and considerations is essential for making informed investment decisions in ETFs.

V. Building a Successful ETF Portfolio

A. Asset Allocation and ETF Selection

Strategic asset allocation is crucial for building a successful ETF portfolio. Investors should assess their risk tolerance, financial goals, and investment horizon to determine the appropriate allocation between equities, fixed income, commodities, and other asset classes. ETFs provide a wide array of options to align with various asset allocation strategies.

Careful selection of ETFs is essential. Investors should evaluate the fund’s objectives, holdings, historical performance, and expense ratio. Matching the chosen ETFs to the desired asset allocation is key to optimizing the portfolio’s performance.

B. Incorporating Different Asset Classes

Diversifying across different asset classes is vital to managing risk and maximizing returns. ETFs allow investors to easily diversify their portfolio by including various asset classes like stocks, bonds, real estate, and commodities. A well-diversified portfolio helps cushion against the volatility of any single asset class.

Strategically incorporating asset classes that have low correlation can further enhance diversification, potentially increasing portfolio stability.

C. Rebalancing and Monitoring

Regularly reviewing and rebalancing the ETF portfolio is essential to maintain the desired asset allocation. Market fluctuations can cause the initial allocation to drift over time. Rebalancing involves adjusting the portfolio by buying or selling ETFs to bring the allocation back in line with the original plan.

Investors should also stay informed about the market and economic conditions, and be ready to adjust their portfolio based on changes in their financial circumstances or market trends.

VI. Strategies for Maximizing Returns with ETFs

A. Dollar-Cost Averaging

Dollar-cost averaging is a disciplined investment strategy where an investor regularly purchases a fixed dollar amount of an ETF, regardless of the ETF’s price. By doing so, investors acquire more shares when prices are low and fewer shares when prices are high, resulting in a lower average cost per share over time. This strategy minimizes the impact of market volatility.

B. Sector Rotation

Sector rotation involves strategically shifting investments among different sectors based on the economic or market cycle. By identifying sectors likely to outperform in a given phase, investors can allocate their ETF investments accordingly. This strategy aims to capture the potential for higher returns by being in the right sectors at the right time.

C. Trend Following

Trend following is a strategy that involves analyzing the market trends and making investment decisions based on the observed trends. Investors using this strategy typically buy ETFs that are trending upward and sell or avoid those trending downward. By riding the trend, investors aim to maximize their returns during favorable market conditions.

Adopting these strategies can assist investors in making informed decisions to optimize returns when investing in ETFs.

VII. Tax Considerations and ETFs

A. Tax Efficiency of ETFs

ETFs are known for their tax efficiency due to their unique structure and the creation and redemption mechanism. ETFs typically have lower capital gains distributions compared to mutual funds. This tax efficiency can result in less tax liability for investors, potentially enhancing after-tax returns.

B. Tax Implications for Investors

Investors should be mindful of potential tax implications when trading ETFs. Selling an ETF may result in a capital gain or loss, which can be short-term or long-term depending on the holding period. Understanding the tax implications of various ETF transactions is crucial for effective tax planning.

Moreover, investors should be aware of dividend taxes for ETFs that distribute dividends, which are taxed at different rates based on factors such as the investor’s tax bracket and the type of dividend.

Being informed about the tax considerations associated with ETF investments is essential for effective tax planning and maximizing net returns.

VIII. Case Studies and Real-Life Examples

A. Success Stories in ETF Investments

In this section, we’ll present real-life success stories of investors who strategically used ETFs to achieve their financial goals. These stories will showcase how different strategies like diversification, sector rotation, or trend following, when applied effectively, can lead to significant investment success.

B. Learning from Mistakes

We’ll also discuss cases where investors faced challenges or made mistakes in their ETF investments. Analyzing these scenarios will provide valuable insights into common pitfalls and errors that investors should avoid. Learning from these mistakes is a crucial aspect of mastering ETF investments.

By examining both success stories and mistakes, investors can gain a practical understanding of how to effectively apply strategies and navigate the ETF landscape.

| Section | Title | Description |

|---|---|---|

| I | Introduction | Provides an overview of ETFs, their benefits, and the importance of investment strategy. |

| II | Understanding Exchange-Traded Funds (ETFs) | Defines ETFs, their operation, and types. |

| III | Advantages of Investing in ETFs | Discusses diversification, cost-effectiveness, and transparency as advantages of ETFs. |

| IV | Risks and Considerations in ETF Investing | Highlights market risks, tracking error, and understanding the underlying index. |

| V | Building a Successful ETF Portfolio | Explores asset allocation, diversification, and portfolio monitoring strategies. |

| VI | Strategies for Maximizing Returns with ETFs | Presents dollar-cost averaging, sector rotation, and trend following as key strategies. |

| VII | Tax Considerations and ETFs | Covers tax efficiency and implications for investors. |

| VIII | Case Studies and Real-Life Examples | Illustrates successful ETF investments and lessons learned from mistakes. |

IX. Conclusion

A. Summarizing Key Takeaways

Mastering Exchange-Traded Funds (ETFs) involves understanding their structure, advantages, and associated risks. Diversification, asset allocation, and strategic ETF selection are key strategies for success. Tax efficiency and monitoring the portfolio are equally vital considerations. Real-life case studies highlight the practical application of these strategies.

Armed with this knowledge, investors can confidently navigate the ETF landscape. Whether aiming for long-term growth, short-term gains, or a balanced portfolio, ETFs offer a versatile investment tool. By employing the right strategies and staying informed, investors can optimize returns and work towards their financial goals.

In this journey, continuous learning and staying updated with market trends and investment insights will be invaluable. Remember, the ETF market is dynamic, and evolving strategies is key to mastering it.

Happy investing and may your ETF journey be prosperous and fulfilling!